5 Reasons You Definitely Should Accept Credit Cards

There are a lot of reasons why businesses choose to be cash-only. For many cash-only businesses, this decision might be purely circumstantial. Rural areas without access to reliable internet or cellular connections might not have the capability to dependably offer credit card transactions. Many business owners are wary of transaction fees, especially in ultra-urban areas like New York City where cash-only businesses are common due to customary practice. There also seems to be a lack of confidence in the security of electronic transactions of all types among many business owners.

Regardless of the impetus for being a cash-only business, we’d like to make the case that if you’re a small business owner who does not accept card transactions, you really should be. Any honest appraisal of the risks and benefits will certainly come out in favor of accepting card transactions. Here are five reasons why you absolutely should be accepting credit cards at your small business.

Easier Bookkeeping

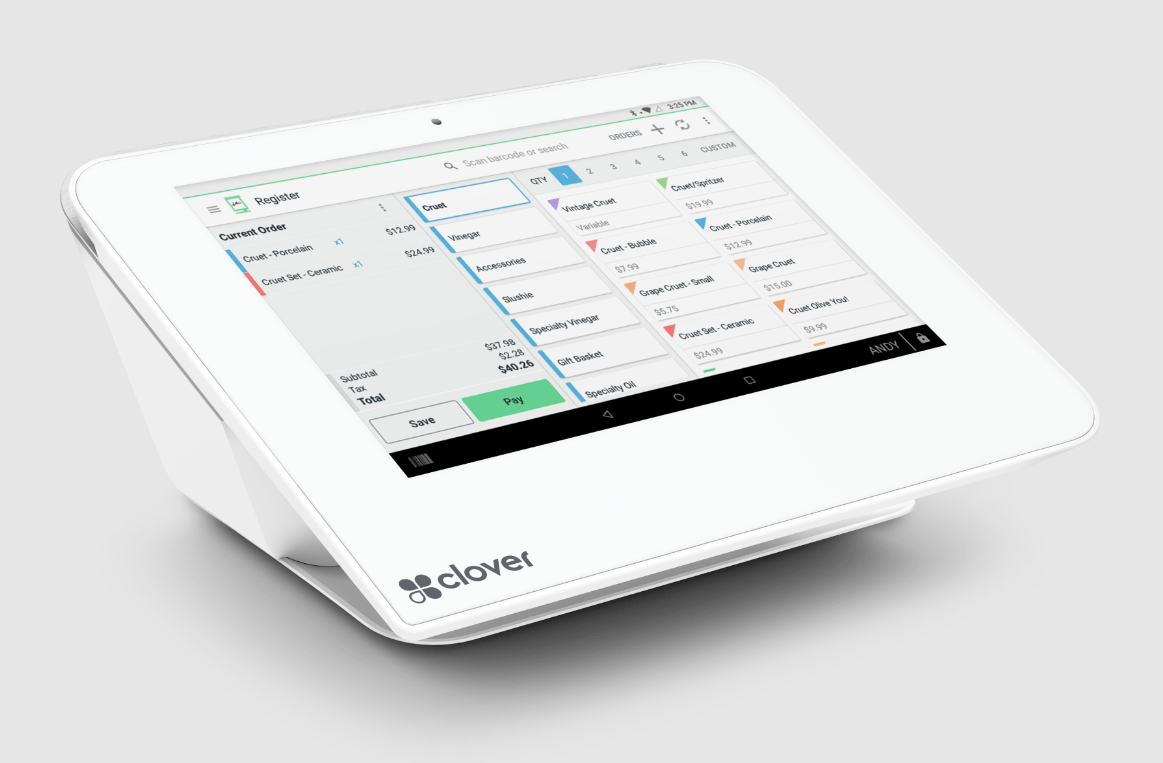

One of the most undersold benefits of credit card transactions is that they automatically create a transaction history. This means that matching sales to revenue requires much less effort on the part of business owners. This transaction history combined with the analytic capabilities of modern POS systems and bookkeeping software, such as QuickBooks, eliminates much of the grunt work come tax season!

Lower Transaction Fees

As card payments have become more common, the industry around merchant services has exploded. This competition has lowered fees from providers vying for customers and has improved the technology dramatically. Long gone are the days of expensive terminal rentals and outrageous monthly costs for services like PCI compliance that are now part and parcel of merchant services packages. It has quite literally never been more affordable to accept credit card payments.

Online Sales are Your Best Friend

One of the most exciting developments to come from the Internet age is the expansion of previously isolated markets. Retail businesses and service providers that were previously relegated to customers with whom they share an area code are now able to access markets all over the world. If you’ve been selling exclusively from your brick and mortar, it’s time to introduce your products and services to the most expansive market that has ever existed. The only way to access consumers around the world is to accept card payments. It’ll change the way you do business forever.

If you still have questions about the benefits of accepting credit card payments, please feel free to reach out to us at any time. We are more than happy to get you on track to take your businesses to the next level!

The Customer is King in Matters of Taste

It’s a maxim familiar to all small business owners. If your customer is willing to pay extra to add chocolate syrup to their tuna fish sandwich, noblesse oblige. We’d plead the case that this business mentality also applies to preferred methods of payment. According to the 2020 report from the Diary of Consumer Payment Choice published by the Federal reserve, credit and debit cards combined were the preferred payment methods for all age aggregates. Furthermore, polling suggests that 41% of customers will completely avoid your business if you don’t offer their preferred method of payment. To put it simply, customers expect to have the option of paying by card, so if you’re not offering credit card payments you are not only missing out on business, you are actively driving it away.

Greater Security

Technology has come a long way, and it only continues to innovate. The advances made in transaction processing security are truly stunning. Card chip payments, contactless payments, and phone based payments have added an extra layer of fraud prevention to transactions. In fact, many types of contactless payments use a completely randomized token to complete transactions so that the bank account and credit card number of the customer is not even used! This not only reduces the liability of business owners, it has also led to much greater confidence in card transactions among customers. Cash payments have the benefit of not being connected to any digital services, however, it’s no less vulnerable to theft than it was 20 years ago. Card transactions keep your money well guarded and much easier to recover in cases of fraud.